Sweet are the ways of adversity, so goes the old line from the Bard. There were for no dearth of misfortunes in 2020. But it also opened up new vistas for some industries and technologies.

The pandemic and the lockdown that it triggered forced much of the population indoors. This, of course, ensured that individual homes combined both work and recreation. With cinema halls shut, people veered to home-based entertainment. And suddenly, OTT platforms, which hitherto were mostly urban-centric, became much sought after across the country and as the year draws to a close, it can be said without any ambiguity that the streaming platforms have well and truly arrived.

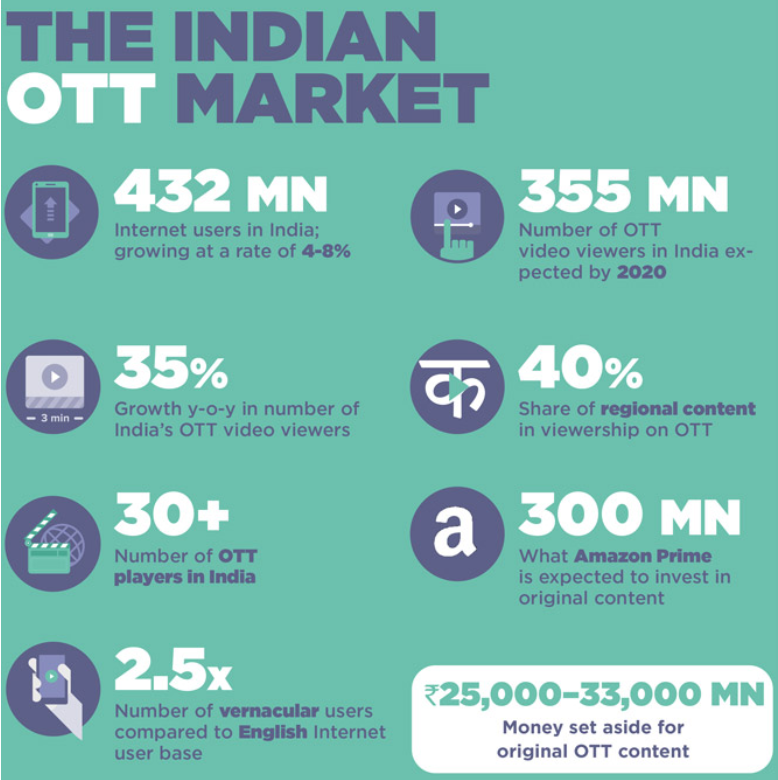

Apart from a plethora of original web series, at least 35 movies, across various Indian languages, were released first on the OTT platforms. Some of them became pan-Indian hits because OTT platforms are not confined by geography. As on December, India has reported 355 million OTT viewers -- a 35% year-on-year growth.

Disney+ Hotstar, Amazon Prime Video, Netflix India, Sony Liv, Zee5, Alt Balaji, Aha and a few other regional players have all become a tour-de-force in the multi-million dollar entertainment arena. And what's more, these platforms are going for sports, the traditional mainstay of cable and satellite television networks.

- Netflix's StreamFest a big hit - 8 lakh new app downloads in India

- Indian OTT platforms make a beeline for Tamil content

- Amazon Prime Video to globally premiere nine Indian movies

The rapid rise of OTT, the slow decline of DTH concept

OTT platforms are now a whopping Rs.5000 crore industry in India, and the country had around 40 mainstream OTT services in early 2020. By year-end, though the total number of such platforms did not increase by much, their business grew manifold.

The 5 metro cities account for 60% of OTT usage. Indians under the age of 35 years account for 90% usage. Males account for 80% usage.

As more people began to log into OTT platforms, at the height of the lockdown, the government had to order the platforms to suppress the use of bandwidth so that it is available for other emergency needs.

Of course, OTT networks were always going to be the future. But the situation that the country found itself this year hastened the whole process, and now OTT revenues and user-base are seeing a phenomenal spike.

OTT's spectacular rise was also helped by the concomitant growth in the availability of smart televisions in the market. Smart TVs are now on offer from as low as Rs 10,000. Of course, in a country like India, where mobile data charges are one of the lowest, people are ready to consume OTT fare on mobiles and laptops, too.

It is estimated that 45-55% of the digital advertising budget is now spent on mobile advertising and this share is likely to increase to around 65-70% by 2022.

The number of active OTT advertisers also grew 45% from 24 in Q1 2019 to 35 in Q1 2020.

The ads began to flow right in the first month of the lockdown. The average ads insertions per day by OTT platforms in March 2020 was almost 4,500, a huge jump from 2,881 insertions in February this year.

OTT's rise has contrasted with the falling subscription for cable and satellite networks in India. As per one report, the TV channels saw a decline of close out to 20 million in India this year.

Platforms like Voot, Sony Liv, SunNXT and Zee 5 are OTT platforms developed by existing broadcast channels to remain relevant and to cater to the shift in audience from TV viewership to OTT platforms. However, most of their content on these platforms are the same as the ones broadcast on their channels.

Now, Friday big releases are in your drawing room

The year saw for the first time movies, even big budget ones, being released on streaming platforms directly. A phenomenon unthinkable even at the start of the year. Of course, this was more by exigencies of the situation than by wilful choice. Some films had to release rather than lie in the cans.

Cinemas were closed since March 2020 and opened recently with drastic reduction in their capacities due to social distancing measures. Multiplex owners say that under the new rules they are about to lose around 40% of their pre-Covid revenue.

Indian film industry produces around 2,000 films per year. It generated a revenue of around Rs 19,177 crore ($2.6 billion) in 2019, selling over 2 billion tickets, and providing employment opportunities for millions of Indians. The pandemic delivered a body blow to the business model of this industry.

Though OTT platforms cannot offset the entire industry's losses on various fronts, it has at least opened up a vista for some of the content to be monetised.

Impelled by the growth in 2020, streaming platform biggies like Netflix, Amazon Prime Video, and Disney+ HotStar are expected to up their original content investment in 2021.

According to an industry report they are expected to collectively spend approximately Rs 2825 crore ($383 million) on original content in India, dwarfing the Rs 2080 crore ($282 million) by local OTT players.

The local players include SunNXT, Aha, Eros Now, SonyLIV, MX Player, Voot, ALTBalaji, Jio TV + Jio Cinema, Hungama Play, and others. These OTT players are collectively expected to spend Rs 4905 crore ($665 million) in 2021.

Digital streaming platforms overtook film entertainment to rank the third-largest Indian Media & Entertainment sector in 2019, according to the EY-FICCI Indian Media & Entertainment Report.

Digital’s newfound dominance has reasons to unnerve and challenge the authority of top studios and Bollywood bigwigs.

But concerns over content persist

So far there was no specific law for digital content providers and news platforms, and the segment was not directly regulated by any particular ministry. As the segment grew, the Indian government has thought it fit to bring it under the ambit of Union Ministry of Information and Broadcasting. Till now, they were governed by the Information Technology Act, 2000.

Now the I&B Ministry will have more authority to wield against the OTT platforms too, many of whom till now felt the ministry lacked the legislative powers to control them.

And there has been some queasiness over the content, with calls for censorship of the fare that get streamed on these platforms. The industry offered to self-regulate, but a few voices on the excessive violence and nudity continue.

The federal ministry for Information and Broadcasting, however, told the Internet and Mobile Association of India (IAMAI) to reconsider its self-regulation proposals, and warned that it would not be supporting them till they create a mechanism for independent third-party monitoring and a code of ethics.

Now IAMAI is expected to come out with another code called the 'implementation code'.

Platforms drive content and creativity, too

As filmmakers started to realise that movie-viewing experience for families are not going to be the same anymore, they began churning out films that have stories and treatment that suit watching on home devices. Industry analysts are already predicting that theatres will attract only star vehicles or grand movies that need big screen projection. Also, the technology to make movies and also equipment used for post production will be increasingly online and remote.

We already got a glimpse of that this year. The Malayalam movie C U soon (Amazon Prime Video) was made during the height of pandemic and the lockdown, It was shot, mostly, on mobile phones and home equipment by the actors themselves. The movie was put together by technicians in different locations. Interestingly, the film's story itself happened on screen.

In another offering on Amazon Prime Video, Putham Pudhu Kaalai in Tamil, the story dealt with an anthology of five different couples facing unique situations during the lockdown. And the stories were shot within five different homes.

- Top-5 Bollywood 1970s comedies to watch on Netflix

- Bollywood flick 'Gunjan Saxena: The Kargil Girl' to premiere on Netflix

- Ten Bollywood flicks on Amazon Prime

- Eight Malayalam films that you must definitely watch on Amazon Prime

Regional content to the fore

As can be seen, OTT offerings are quickly adapting to constraints of the situations and are overcoming through technology. What more, the content is also change with the needs of the time and the platform.

Talking of content, OTT platforms are also helping regional language filmmakers to get a national audience. Good subtitles (in different languages) have meant that movies are now available to various groups of people. Suddenly, a larger part of India is waking up to the beauty of Malayalam, Tamil, Telugu movies.

Movies like Soorarai Pottru (Tamil), Middle Class Melodies (Telugu) became national hits --- something that was thought to be impossible a few months back. It is said that 40% of the content on Indian OTT platforms are in regional languages. Already platforms are making a beeline for India language content.

In web series, which do not have a censor board as such, content is getting edgy and interesting. And alas, some of the stuff are also borderline porn.

Trade analysts say more than 400 original titles will be released in 2021 from US and Indian players, with the total of original productions moving closer to 1,000 per year by the second half of the decade.

But films are not the biggest draw

As irony would have it, films were not the biggest draw on the OTT platforms this year. It was cricket, more specifically IPL (Indian Premier League) was the major grosser in terms of revenues and major crowd puller (in terms of viewership).

It kind of helped Disney+ HotStar to cement its place as the top OTT platform in India. It was followed by Amazon Prime Video and Netflix India.

Netflix India is more focused on film and entertainment content, and its StreamFest was a big success. Its mobile only plan is also a major draw. On the other hand, both Amazon Prime Video and Disney+ HotStar are chasing sports rights too. Buoyed by the numbers that 2020 has given them, they are now going for broke. They are now targeting the other foundation stone of television networks --- sports telecasts.

For the first time ever in these parts, Amazon Prime Video won the broadcast rights for cricket from New Zealand.

It is also said to be angling for the IPL and Indian cricket rights.

Facebook also did a deal with Sony to stream some clips from the India-Australia cricket series. Facebook, of course, is the official platform for streaming Spanish Football League La Liga in India.

Netflix and Amazon Prime Video are the two largest investors in Indian original content. In the three-year period 2017–19, both invested almost Rs 3687.9 crore ($500 million). The Indian OTT players are gradually scaling up their investment, and the industry expectation is that they will match the level of spending of the US giants in 2021.

The future is clearly bright for OTT platforms in a fast-digitizing nation. But platforms have to continuously cater to the demands of ever-changing tastes of the users, and also resolve the prevailing challenges in user experience.

December 16, 2020 at 01:41PM from TechRadar - All the latest technology news https://ift.tt/2WjrdS3

via IFTTT

No comments:

Post a Comment